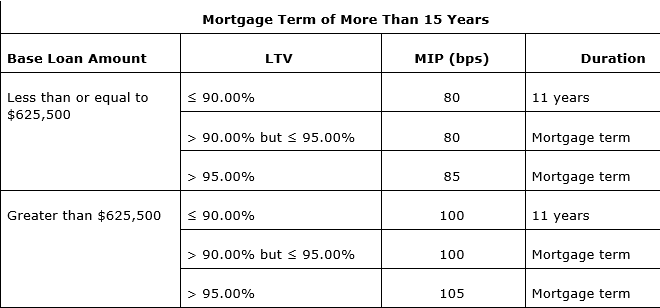

FHA stands for Federal Housing Administration. These loans are insured by HUD (Housing and Urban Development). The minimum downpayment requirement on FHA is 3.5% of the purchase price. Credit requirements are usually more lax than conventional loans and you can even be approved for financing if you have no credit scores. You pay an upfront fee of 1.75% of the loan amount (in addition to your other loan fees) and a monthly mortgage insurance premium. The upfront fee can be financed back into the loan amount and the monthly insurance premium is determined by your downpayment and loan amount:

If you’re buying a $300,000 home, you would need to make a downpayment of $10,500. Your loan amount would be $289,500. Your upfront FHA fee would be $5066.25. You can finance $5066 of the upfront fee back into the loan amount or you can pay it in cash. Assuming you pay it in cash, the monthly FHA Mortgage Insurance Premium is calculated by taking your loan amount of $289,500 multiplied by .0085% and dividing that by 12 to get $205.06 per month. This monthly mortgage insurance premium is in addition to your principal and interest, property taxes and homeowner’s insurance premium.

While FHA guidelines are a little more lax than conventional financing, many lenders still require a minimum credit score of 620 for qualifying. A lower credit score is permitted but only if you’re able to put more money down. If you have no credit scores, you could still be approved under FHA if you have a history of paying rent and/or utilities.

FHA does have loan limits based on the county you're in. Here are some local counties for your quick reference or click here to search for your county's loan limits.

Portland-Metro including Vancouver: $491,050 for single family residence.

Marion County including Salem: $342,700 for single family residence.

Waiting Periods From Derogatory Credit Events

-Two years from discharge of bankruptcy.

-Three years from a short sale which begins on the date the title was transferred.

-Three years from foreclosure which begins the date the title was transferred out of the borrower’s name.

Pros

-Higher debt-to-income ratio allowances.

-Shorter waiting periods from derogatory events.

-Lower monthly mortgage insurance premiums than conventional for those with lower credit scores.

-No credit scores required for those who have no credit.

-Easy refinance process with a Streamline Refinance.

-Low interest rates compared to conventional.

Cons

-Monthly mortgage insurance premium is required for the life of the loan if you’re not putting at least 10% down.

-Upfront 1.75% fee which is not charged on conventional loans.

-Monthly mortgage insurance premium may be more expensive than conventional if you have great credit.

-No Lender Paid Mortgage Insurance options.